The payday-loan business was in decline. Regulators were circling, storefronts were vanishing and investors were abandoning the industry’s biggest companies en masse.

And yet today, just a few years later, many of the same subprime lenders that specialized in the debt are promoting an almost equally onerous type of credit.

It’s called the online installment loan, a form of debt with much longer maturities but often the same sort of crippling, triple-digit interest rates. If the payday loan’s target audience is the nation’s poor, then the installment loan is geared to all those working-class Americans who have seen their wages stagnate and unpaid bills pile up in the years since the Great Recession.

USA Fast Cash Loans in California, CA usafastcashpaydayloans.com/category/california-ca

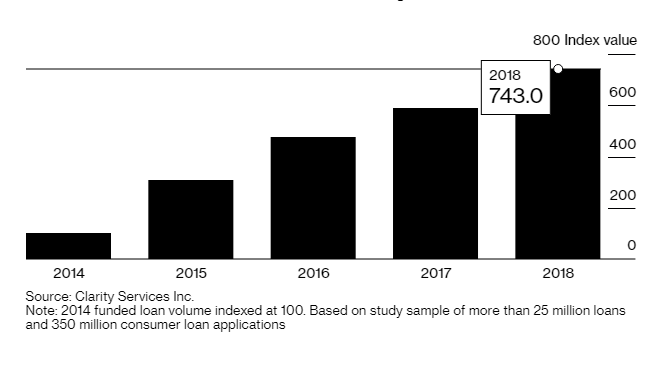

In just a span of five years, online installment loans have gone from being a relatively niche offering to a red-hot industry. Non-prime borrowers now collectively owe about $50 billion on installment products, according to credit reporting firm TransUnion. In the process, they’re helping transform the way that a large swathe of the country accesses debt. And they have done so without attracting the kind of public and regulatory backlash that hounded the payday loan.

Borrowing Binge

Online installment loan volume continues to surge

“Installment loans are a cash cow for creditors, but a devastating cost to borrowers,” said Margot Saunders, senior counsel for the National Consumer Law Center, a nonprofit advocacy group.

Subprime Evolution

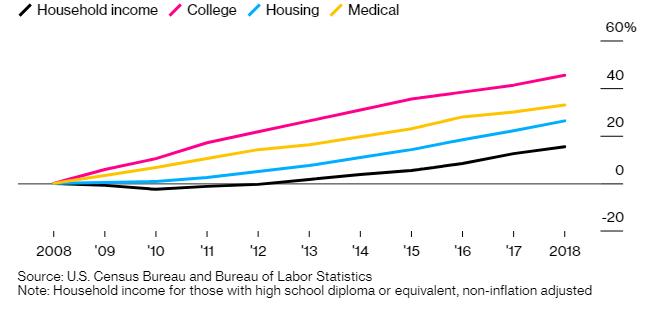

For many families struggling with rising costs and stagnant wages, it’s a cost they’re increasingly willing to bear.

In the decade through 2018, average household incomes for those with a high school diploma have risen about 15%, to roughly $46,000, according to the latest U.S. Census Bureau data available.

Not only is that less than the 20% increase registered on a broad basket of goods over the span, but key costs that play an outsize role in middle-class budgets have increased much more: home prices are up 26%, medical care 33%, and college costs a whopping 45%.

To keep up, Americans borrowed. A lot. Unsecured personal loans, as well as mortgage, auto, credit-card and student debt have all steadily climbed over the span.

Falling Behind

Household income hasn’t kept up with key costs over the past decade

For many payday lenders staring at encroaching regulatory restrictions and accusations of predatory lending, the working class’s growing need for credit was an opportunity to reinvent themselves.

They “saw the writing on the wall, and figured, ‘let’s anticipate this and figure out how to stay in business,’” said Lisa Servon, a University of Pennsylvania professor specializing in urban poverty and author of The Unbanking of America: How the New Middle Class Survives.